Future Calendar Spread Spectacular Breathtaking Splendid

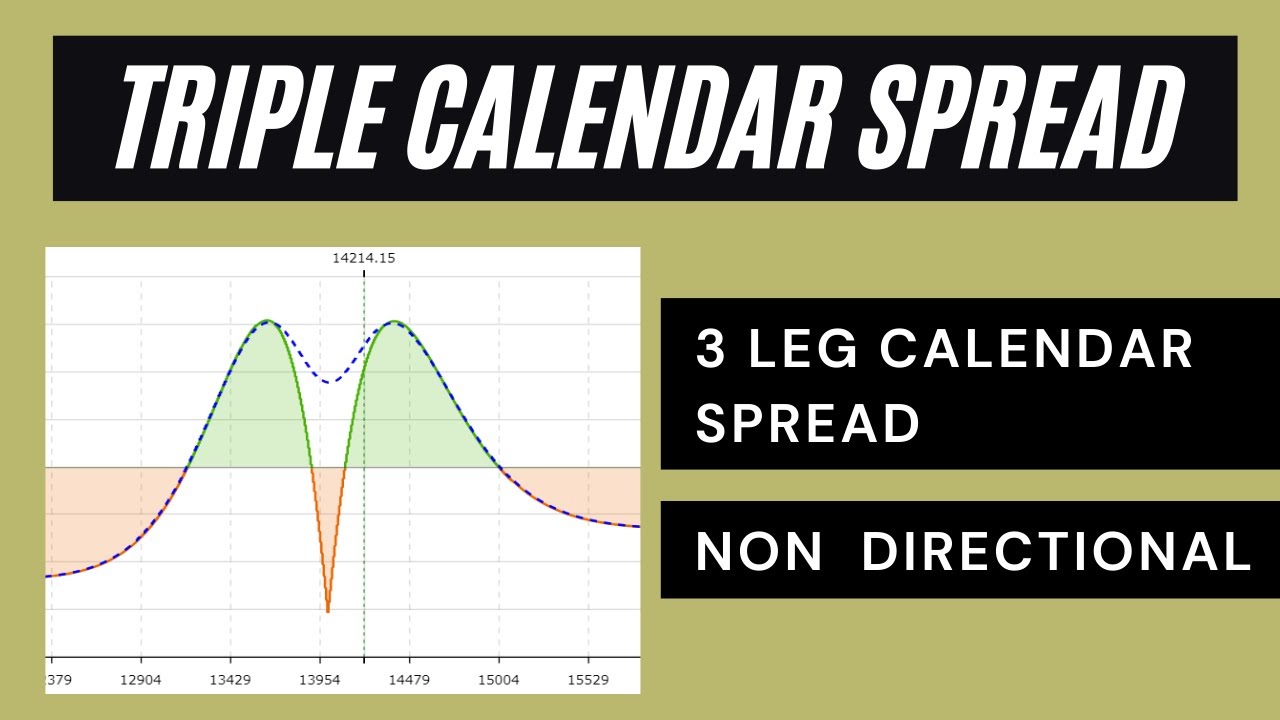

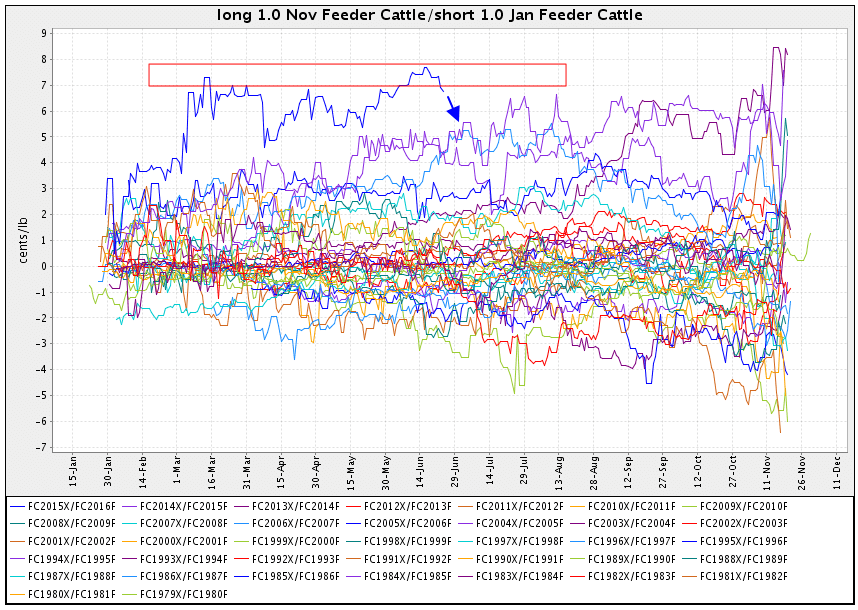

future calendar spread. A futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to capitalize on. If you want to use calendar spreads for income, the good news is that calendar spread earnings tend to be higher than other debit or credit spreads.

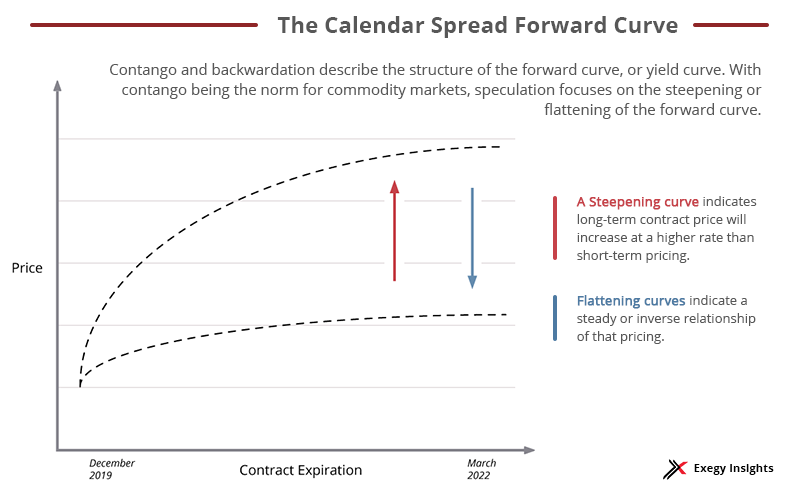

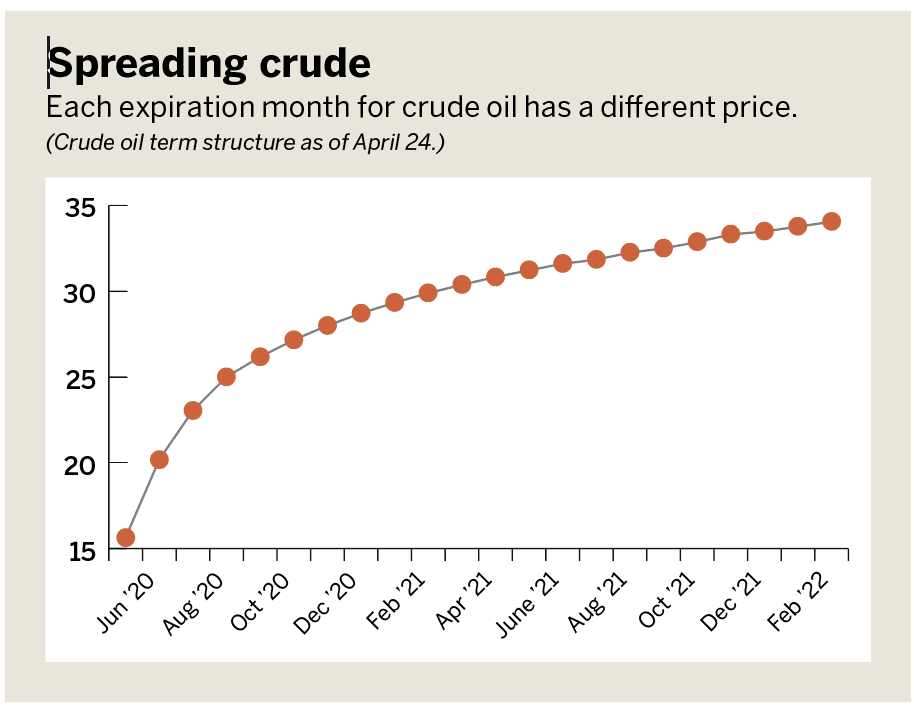

future calendar spread A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset. If you want to use calendar spreads for income, the good news is that calendar spread earnings tend to be higher than other debit or credit spreads. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module.

I Had Briefly Introduced The Concept Of Calendar Spreads In Chapter 10 Of The Futures Trading Module.

A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset. A comprehensive guide to calendar spread. Learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more.

Futures And Options Trading ›.

Ultimately, utilizing this strategy is an effective way to minimize risk. If you want to use calendar spreads for income, the good news is that calendar spread earnings tend to be higher than other debit or credit spreads. Calendar spreads are useful in any market climate.

A Futures Spread Is An Arbitrage Technique In Which A Trader Takes Offsetting Positions On A Commodity In Order To Capitalize On.

Traditionally calendar spreads are dealt with a price.

Leave a Reply